Mongabay | 8 September 2016

The 101 on how global trade treaties came to threaten the environment

by Jennifer Huizen

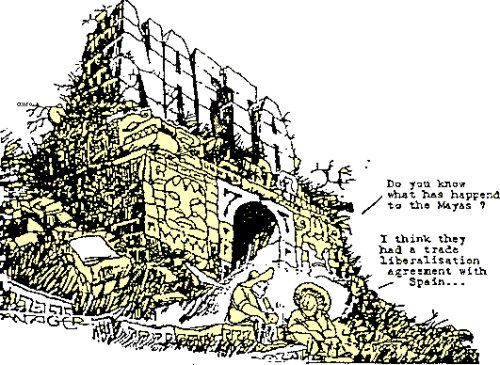

A host of trade treaties are in negotiation around the globe, many of which, say critics, stand to enrich investors at the expense of the environment and ultimately, democracy, threatening the right of individual nations to pass and impose laws meant to protect their citizens and nature. In this four part series, Mongabay dives deep into the history of global trade to explain how we got to where we are today and what may lay ahead.

Part One is an origins story, beginning in a period of economic recovery and great hope after two World Wars and the Great Depression.

In an ideal world, international trade treaties would have tremendous potential for protecting the environment. With their global reach, they might, for example, be one of the few policy tools available possessing the authoritative heft to make the Paris Climate Agreement national emission reduction commitments stick.

But in the rough and tumble legalistic world of geopolitical trade negotiations, the system that births such treaties is often tipped advantageously toward corporate profit and investor protection, and against the environment, and by virtue, national sovereignty — at least that’s what critics say.

Such accusations have been made lately against a bewildering alphabet soup of global treaties now under negotiation, including the TTP, TTIP, and TISA.

NAFTA protests rage on worldwide, reignited by recent Chapter 11 cases and the threat of new and looming trade treaties such as TTP, TTIP and CETA. Photo by Billie Greenwood licensed under the Creative Commons Attribution-Share Alike 2.0 generic license

Yet for as flawed as the current system may be, it seems such investor protections were originally created with the best of intentions — as over the last century the globe saw horrific political volatility. Economic booms and busts, coupled with civil uprisings and wrenching regime changes, caused cautious foreign investors to fight for protection in the form of stronger investment provisions in trade treaties.

One major result of these struggles was the creation of the Investor-State Dispute Settlement (ISDS) mechanism in 1966. Approved by a host of nations, and unused for decades, this tool today is decried by its opponents as antithetical to both transparency and democracy. It entitles foreign investors, they say, to the same or greater legal rights as a nation’s citizens. And it moves treaty arbitrations out of the bright light and public eye of domestic courts and into the unseen backrooms of institutions like the World Bank’s International Dispute Resolution Center in Washington, D.C.

“When you explain how ICSID [International Center for Settlement of Investment Disputes] works to people, generally they find it hard to believe,” said Scott Sinclair, Director of Policy Alternatives Canada, an NGO. “These provisions were created to protect foreign investors against grievous behaviors in situations where justice was unlikely in domestic courts,” when one government violently overthrew another, for example, and then backpedaled on its treaty commitments.

“But now it’s an alternative used [by investors to press suits] even in places with well-established courts. Even scarier, environmental issues are at the heart of a lot of disputes, and often the public only becomes aware of such cases after the fact.”

Many of the biggest ISDS cases in recent years have involved investor challenges to national sovereignty, hoping to invalidate environmental laws to gain access to foreign natural resources or markets. In some instances this has resulted in the overturning of laws set up by governments to protect the environment and ensure public safety in favor of investor profits and protection.

To date, 696 ISDS cases have been filed against 107 countries, and by 2014 countries worldwide had shelled out in excess of US $440 million to investors for treaty violations.

And that doesn’t include suits recently completed or now in process. The passage of time has seen a rapid raising of the bar regarding award size. Just last year an ICSID court negotiated Ecuador’s award to Occidental Petroleum downward to US $1 billion. (The company claimed the South American country wrongfully terminated their Participation Contract to exploit a block of Ecuadorian land for oil production.)

And as of 2016, the US government could be on the line for US $15 billion owed to the TransCanada Corporation in compensation for the federal government’s rejection of the Keystone XL pipeline.

The European Trade Commission estimates investors win disputes in about a quarter of such cases, while states win a little over a third, with another third settled out of court — each dispute costing an average of US $8 million in legal fees. So taken together, litigating the 696 cases cost roughly US $5.6 billion — with trade lawyers numbering among the big winners.

With ISDS clauses already written into the more than 3,000 investment agreements already in-force globally, and also written into all of the big international trade treaties currently on the table right now — like TTP, TTIP and TISA — it’s easy to see why many environmental, public health, pro-democracy and labor NGOs have raised the alarm.

But how concerned should we be? And what actions can we take to assure that business, nations, the environment and civil rights all continue to thrive alongside one another? The best answer to these questions requires a close examination of the wonky, murky, and according to critics, sometimes unsettling, evolution of international global trade agreements to see how we arrived at this critical moment in history.

Bretton Woods Historical Marker, Carroll, New Hampshire, USA, commemorates the place where the fundamental legal mechanisms underlying modern international trade and globalization were born. Photo by JCardinal18 licensed under the Creative Commons Attribution-Share Alike 2.0 generic license

Great expectations

The catastrophic upheaval of World War I, the Great Depression, and World War II left global markets in ruin. As a result, throughout the first half of the 20th century many nations tightened international trade barriers, raising or promoting tariffs (taxes on imported goods). Some nations even devalued their currency to undercut competition from abroad.

In 1944, forty-five allied nations met in the small New Hampshire town of Bretton Woods to plan the rebuilding of war-torn Europe and the global economy. The International Monetary Fund (IMF), and World Bank were both proposed at the meeting, as was the International Trade Organization (ITO), an international trade regulatory body.

A year later, the World Bank (meant to fund development), and the IMF (meant to maintain world financial order), came into effect with 29 of the Bretton Wood countries ratifying the Articles of Agreement — some 189 nations are members today. The ITO failed to gain enough support.

While the IMF did help stabilize the flow of global funds, the need still existed for an international regulatory agency similar to the rejected ITO, to help govern the investments needed to boost the economy and fund the World Bank’s development projects.

In 1948, eighteen European nations ratified the Organization for European Economic Cooperation, reducing trade barriers such as tariffs. (It became the Organization for Economic Cooperation and Development, or OECD, in 1961.) At the same time, the heavily US backed General Agreement on Tariffs and Trade, or GATT, was ratified by 23 founding nations.

A tale of two dispute mechanisms

GATT is rarely discussed outside insider circles. But in many ways, it’s the modern milestone marking the beginning of investor protection provisions in international trade agreements.

The investor provisions built into GATT weren’t initially large or entirely clear. Primarily, protection focused on ensuring foreign investors got national and most-favored-nation treatment — the same treatment as domestic investors.

Disputes that arose due to a violation of these terms were to be settled by the contracting parties and the GATT council. The GATT chairman determined early cases. Later, small expert panels chosen by the involved parties were given the task of recommending rulings to the council.

But as subsequent foreign investment moved from recovering Europe to developing nations in Africa and elsewhere, the GATT dispute settlement system became vastly more complicated. Bilateral and multilateral trade treaties and investment agreements became all the rage in the second half of the 20th century, linking robust economies with failing or fledgling ones.

“[G]lobal trade expanded at a rapid rate, and what parties found was that each country had their own laws referential to domestic needs,” explained Timothy Lemay, UNCITRAL secretariat and principal legal officer. “There needed to be a common legal standard all could sign onto to remove these kind of blockages to trade.”

The World Bank Group headquarters building in Washington, D.C., housing ICSID. Photo by Shinny Things licensed under the Creative Commons Attribution-Share Alike 2.0 generic license

In 1955, the International Chamber of Commerce (ICC), drafted a document to handle such concerns, which was formalized and adopted by many UN members in 1958 at the Convention on the Recognition and Enforcement of Foreign Arbitral Awards, aka the New York Convention. Two prior agreements, the Geneva Treaties (aka the Geneva Protocol) in 1923 and the 1927 Geneva Convention, had already handled the issue of arbitration enforcement, but hadn’t proven effective.

While a step in the right direction, the terms set at the New York Convention still weren’t robust enough to handle the rapidly evolving global market so trade leaders went back to the drawing board. In 1966, two systems were finally set up with the teeth to handle investor disputes, forming the basis of ISDS. The World Bank proposed a new treaty that beefed up prior GATT provisions: the International Convention on the Settlement of Investment Disputes between States and Nationals of Other States, creating arbitration and conciliation rules for dispute resolution and founding the International Centre for Settlement of Investment Disputes in Washington D.C. to hear cases.

When ICSID first came on the world stage, 20 countries ratified the treaty; today it involves 153. And the nationally agreed to ICSID dispute resolution system, meant to guide the resolution of state-to-state and state-outside nationals (investor or corporate) disputes, applies to a majority of the well over 3,000 global investment and free trade treaties and agreements in existence today.

ICSID cases are tried not in public, but by a panel of three arbitrators selected from ICSID’s permanent pool and with cases convened either in Washington, D.C. or in an international court. In 1978, ICSID added “Additional Facility” arbitration and conciliation rules, to be used in disputes outside of the scope of ICSID, such as between member states and non-member states.

Meanwhile in Europe and also in 1966, the U.N. General Assembly settled on a more hands off approach to investment dispute settlement, adopting the U.N. Commission on International Trade Law (UNCITRAL), a legal body to set the framework and help guide investment disputes. Unlike ICSID, UNCITRAL doesn’t preside over dispute resolution, but instead creates the guidelines for arbitration to be used by consenting parties ad hoc in domestic or international courts like the Permanent Court of Arbitration at The Hague. UNCITRAL appoints 29 U.N. countries as member states (since 2002, 60 member states), aiming to represent varying regions, cultures, and levels of economic development.

“Right from the start the purpose of UNCITRAL was to serve as an arbitration model, building on the terms of the New York Convention,” said Lehmay. “Parties to these treaties can employ whichever method of dispute resolution they like, but to date, UNCITRAL remains the most used in the world.”

At the time, ISDS probably seemed like a great step forward for the global investment economy, protecting foreign investors from extreme fiscal hazards and encouraging economic growth in financially risk-prone parts of the world. But according to the experts, ISDS and in particular ICSID laid the groundwork for many of today’s troubles.

The turning of the screw

ISDS was created to address real threats, predominately nationalization and the appropriation of corporate and investor assets, commonly seen during periods of economic upheaval, political destabilization, civil uprisings, and war, Melinda St. Louis, International Campaigns Director for NGO Public Citizen, told Mongabay.

“The ICSID process worked to get disputes out of individual countries and into international external courts,” which seemed like a logical approach at the time, explained Todd Weiler, an investment treaty arbitration expert.

But ultimately the repercussions of bypassing national courts were far more severe than simply a change in venue.

The experts interviewed by Mongabay repeatedly emphasized the same point: ISDS and ICSID were set up exclusively with commercial interests in mind. And commercial and investment legal courts traditionally handle disputes drastically differently from other courts, prioritizing economic profit and interests above all else. Given the sheer scope of issues investor disputes can touch on — from natural resources to labor standards — the experts claim it’s clear there’s an inherent conflict of interest in the system, one with frightening potential ramifications.

“With ISDS, investors gained [for the first time ever] the ability to bring suits against the state directly,” said Lehmay. “And as with most commercial arbitration, the process and outcome are normally private, occurring behind closed doors. With ISDS, companies can go after governmental standards, laws, and other public interests.”

Companies — backed by nearly unlimited funds and top trade lawyers — have taken advantage of this new leverage with increasing frequency and vehemence.

And while the majority of cases are brought against developing nations, they’re not the only ones at risk. In the past few years, Germany and Canada have shelled out serious cash in damages to private investors in neighboring countries, and in some instances, have even been forced to weaken environmental policies. The US $15 billion TransCanada Keystone XL pipeline suit filed this spring could have a similar outcome.

“Considering the impact [on the common good], you’d assume there [would be] a way for the public to intervene in such proceedings,” said Martin Wagner, managing attorney and director of Earthjustice’s International Program. “But the system was set up without any provision or expectations for civil society to have any involvement in dispute settlement,” leaving the public with no other participatory tool beyond public protest.

Still, the legalistic potentialities of ISDS went mostly unexplored for decades, with the dispute resolution mechanism rarely invoked.

So what sparked the transformation of the system into what many experts described as a “corporate insurance policy”? And why was ISDS allowed to metastasize to the point we’re at today — where corporations can sue sovereign countries for mega-millions, and even overturn domestic environmental laws?

The simplified answer? NAFTA.

The three amigos

As already noted, the economic concerns that ICSID was created to handle were very real. The world barely waited for the dust from World War II to settle before engaging in major conflict again, impacting global markets. The so-called Cold War turned hot, and ripped through Southeast Asia and the Middle East, while battles for colonial independence and sovereignty raged in Africa and elsewhere.

In the late 1980s, markets started to settle down and international investment took off. Carla A. Hills, United States Trade Representative from 1989 to 1993, explained that the US was ready to make a trade deal with just about anyone during this era.

“[W]e wanted [to] open trade in the whole hemisphere,” said Hills. In the winter of 1990, Mexico’s trade minister approached Hills about making a trade agreement. So she went to Republican President George H. W. Bush and secured fast-track authority, moving the deal forward without a vote from Congress.

“Around then, I got a call from John Crosbie, Canada’s trade representative, who said ‘Carla, you’re not going to leave me out!’” Hill chuckled. “I couldn’t believe it. The Canada-US free trade agreement just years before had almost taken down the Canadian administration.”

And thus negotiations for a complex trade partnership linking the US, Mexico, and Canada — the North American Free Trade Agreement aka NAFTA — got underway.

Well before NAFTA, Canadians feared the impact of trade deals with big American corporations. A 1911 Conservative campaign poster warns that the big American companies (“trusts”) will hog all the benefits of reciprocity as proposed by Liberals, leaving little left over for Canadian interests. Image in the public domain

Then came a major roadblock: the November 1992 presidential election. Democrat candidate Bill Clinton had gently campaigned against NAFTA since it didn’t include the concerns of his constituents in the labor or environmental movements. Once in office, he decided to satisfy those supporters by grafting amendments to the deal, making up for the labor and environmental gaps in the treaty with two Side Agreements, one to address each matter independently.

Rather ironically, this hybridization, or as the experts put it, afterthought, has done little to mitigate the environmental fallout of NAFTA and in many ways, has increased the damage done.

NAFTA’s environmental Side Agreement created The North American Commission on Environmental Cooperation or the NACEC. It dictated the creation of the Commission on Environmental Cooperation, or the CEC, a group run equally by each of the three nations to oversee the impacts of trade on the environment and receive submissions from citizens concerning countries failing to uphold environmental laws.

The idea was that citizens and countries with more progressive environmental ideals, like the US, would act as watchdogs — calling out their neighbors for environmental shortcomings and contradictions. Once a submission had been filed, the CEC secretariat would decide whether or not to investigate the details of the complaint, and if a problem was found, create a factual record.

“People were excited, especially in Mexico, because the country didn’t have a citizen provision to sue the government or polluters. This seemed like a free and open mechanism to do so,” said Chris Wold, Professor of Law at Lewis and Clark Law School and Director of the school’s International Environmental Law Project.

But, say the experts, the system was seriously flawed from the start, and its faults have only become more obvious and egregious over time.

“The NAFTA Side Agreement is widely recognized as the first time trade treaties formally included environmental provisions, added as an amendment in the final hour of negotiations to placate the major worries people had even then,” said Carroll Muffett, President and CEO of the Center for International Investment Law (CIEL).

As a result, the Side Agreement’s language was vague, and the enforcement mechanism designed extremely weak.

Few know more about this weakness than Gustavo Alanís Ortega with the Mexican Center for Environmental Law (CEMDA). He served two terms on the Joint Public Advisory Committee of the CEC, and in 2015, was president.

“In those days, there was a lot of discourse and debate about Mexico’s lack of environmental standards and enforceable laws, and some idea our neighbors could influence us for the good,” said Alanís Ortega. “Also, increasing trade, investment, and development — all things Mexico needed — was important”.

“In some ways, I think the environmental standard of NAFTA was very high; it was a good step forward,” Alanís Ortega said. But built-in conflicts of interest crippled the authority of the CEC and rigged the game, he explained, especially because the accused countries in a dispute were given a vote on whether an investigation is warranted, and in the end, whether the CEC secretariats’ record is accepted.

“The process is set up so that even if the secretariat is given the green light to investigate the complaint and it is accepted, the end result is only a factual record without any legal [binding] power,” he said.

On top of this, the CEC has always been grossly underfunded. “Since we began, our budget has been the same, US $3 million per government,” said Alanís Ortega. “And this US $9 million total is not the same value today, [it is reduced] because of inflation.”

Despite these problems, the CEC did have some impact early on. “Most of our early submissions did end with factual records. We felt early on the system had a tendency to work,” said Randy Christensen, a staff lawyer with Ecojustice since 1997. “But countries reacted to the actual use of the system in a way that changed management to basically neuter authority.”

“Consider the fact that, to date, the number of submissions [of complaint] brought against the US that have actually gone forward is zero,” said Alanís Ortega. “I think this alone is enough to show a major lack of confidence in the system, though in the US there are domestic methods [federal and state laws] to fall back on.”

Public Citizen’s Melinda St. Louis argued that because the Side Agreements were an afterthought, there’s little that can be done to ever make the commission a powerful or influential presence. She said tweaks had been made along the way, but they were insignificant and the commission never gained teeth.

“The core of the model was not meant to protect labor standards or the environment, [but] rather to ensure groups were appeased without actually impacting investors’ profit margins,” she said.

CIEL’s Muffett noted that after two decades of using the citizen submissions system, the CEC has failed to get results. “While it takes a massive amount of resources and funds to bring about claims and file submissions, none have resulted in meaningful change,” he said. “The Environmental Side Agreement, like the environment chapters that came after, w only ever designed to be a political tool, like the hood ornament on a car. They look pretty, but sure won’t help you drive, steer, or stop.”

NAFTA’s Chapter 11 and the trouble with tuna

While it’s clear the CEC had unresolvable issues from the start, even if drastically altered, another part of NAFTA serves as the ultimate investor trump card.

Known as Chapter 11 — primarily intended to protect US investors from the risk of corruption and destabilization in Mexico — the provision has instead become a lucrative tool for companies and corporate lawyers. And few things have brought bigger reward sums than investments involving natural resources.

“When things really went off the rails was with the now, and really even then, infamous Chapter 11 investment provisions,” said Wagner.

Chapter 11 was a Pandora’s Box, which once opened, unleashed the true power of ISDS. Corporate attorneys quickly learned how to play the system, building up a whole new industry to extract as much profit as possible from sovereign nations and in the process vastly increasing corporate leverage. Today the annual average number of ISDS filings sits at around 50, up from a handful per year in 1990.

The US Department of Commerce’s Tuna Safe track record, and protections of dolphins, were weakened by early dispute cases invoked under GATT provisions. Those cases inspired this protest graphic against the WTO. Image compliments of Public Citizen.

One of the earliest important dispute settlement cases — while technically a government-to-government suit — was the controversial tuna-dolphin case. The US Marine Mammal Protection Act had set strong standards for all domestic and foreign fleets fishing in the Northeastern Pacific Ocean, which banned the use of purse seine nets, a commonly used method for catching large schools of yellow fin tuna that also catches and often kills other marine wildlife like dolphins.

Exporting countries were tasked with proving their tuna were caught without the use of purse seine nets. Because Mexico didn’t keep records on the matter, they couldn’t meet US standards and their exports were banned. In 1991, Mexico called for a dispute settlement under the current GATT provisions to remove the US embargo.

“The impact of the case was massive,” said Wold. “The panel ruled [that] the US had indeed violated investor provisions because they couldn’t distinguish products based on the way they were produced, but rather certain physical characteristics and attributes.”

The panel also declared that one country couldn’t impose its domestic policy on another country through trade sanctions, which goes directly against GATT addressing the right for nations to act outside trade terms in order to protect exhaustible natural resources.

To make matters worse, several so-called “intermediary countries” from around the world — including France, the UK, Japan, Costa Rica, Canada and the Association of Southeast Asian Nations — worried the embargo would extend to their own exports, rushed to support Mexico, strengthening its case and ultimate victory against the United States.

Wold said he and others in the environmental community saw the tuna-dolphin case as an alarm bell. Though the US and Mexico settled the dispute out of court, the impact of the ruling was influential and far reaching.

“The gist of this analysis was fully embraced by the investment community, [and] used in many ISDS disputes… ever since,” he said.

Paradise lost

In 1994, when the WTO formed and replaced GATT, a new body was created to handle investor disputes, called the Dispute Settlement Body. Its purpose was to help dispute parties navigate cases in a manner similar to UNCITRAL, offering negotiation and consultation services plus other resolution options, such as a three-expert panel to compile reports.

“The formation of NAFTA and the WTO happened around the same time, and both more or less mark when trade deals morphed to encroach on issues well beyond what is typically considered trade,” said St. Louis. “You normally think of trade treaties reducing things that lower trade barriers like tariffs. But here, domestic policy and [environmental and labor] regulation came to be viewed as a barrier to trade, and things have gone downhill since then.”

Increasingly, international trade disputes have framed national environmental laws not as a sovereign right, but as unfair free trade restrictions.

The first WTO dispute came in 1996. The European Union in an effort to protect its citizens from perceived health hazards had, since the 1980s, banned domestic and imported meat from livestock raised with a number of synthetic and natural hormones. In 1996, these regulations were updated, adding six additional hormones, three natural and three synthetic. Producers in EU member states however were allowed to use the three natural hormones, and the others as needed per veterinary orders.

That year Canada and the US brought complaints to the WTO, calling the regulations a case of unfair treatment. The WTO panel met to handle both disputes, and ruled that the EU had violated aspects of the Agreement on Sanitary and Phytosanitary (SPS) Measures, just signed by member nations at the birth of the WTO. They also concluded that the EU had not set regulations based on risk assessments.

The EU appealed the ruling and the dispute continued until 2011.

From 1999 throughout the dispute period, both the US and Canada were allowed to impose massive tariffs on EU goods, but after the signing of the Memorandum on Beef Hormones in Brussels in 2009, these tariffs were set to taper off in exchange for the duty-free import of big quantities of American beef — sans the banned hormones.

Wagner said these cases woke up the environmental community to the threat posed by trade treaties — now that trade lawyers had broadened the dispute settlement system into one where environmental safeguards were seen as trade restrictions.

“At this point we decided this was a mounting issue, with the potential to impact far more than just trade and corporations,” said Wager. “These rulings and cases truly had the potential to impact people, and [environmental] policy, all over the world.”

Turtle-excluders and the race to the bottom

The next dispute to majorly challenge environmental standards and national sovereignty came in 1998, when India, Pakistan, Malaysia and Thailand brought a WTO dispute suit against the US for banning the import of shrimp and shrimp products. As in the tuna-dolphin dispute, strict US environmental laws were the basis of the challenge.

Since 1973, the Endangered Species Act had prohibited the “take” (capture, killing, or harassment) of all five species of sea turtles found in American waters. This led to the banning of seafood harvested without turtle-exclusion devices (TEDs).

Wold said that environmentalists had worked for years to get the turtle-excluder devices rules implemented, and the rules’ enforcement had reduced domestic turtle death rates due to bi-catch nearly to zero.

But US shrimpers felt that the cost of equipping their vessels with turtle-protection devices gave foreign shrimpers, who weren’t required to have the devices, an advantage. So the US State Department invoked Section 609 of US law 101-102, banning the import of shrimp products harvested or raised without turtle-excluders.

“Yet again, the tuna-dolphin ruling shone through, with the WTO panel deciding the US had discriminated against products based on their production method,” said Wold. The appellate body ruled the US was guilty of arbitrary and unjustifiable discrimination.

But not all was lost, added Wagner. He said because Earthjustice and other NGOs were backing the US government’s position, they agreed to attach civil notes to the WTO submissions in the form of an amicus curiae. Ultimately, the appellate body disregarded these notes, but it was still a small success — a case in which civil voices were heard in an investment dispute, potentially opening up the WTO process to future NGO input.

“I wish I could say the impact has been more than it has [been], but this [NGO] inclusion has been allowed a few times here and there in other cases since then, and does allow arbitrators some sense of the impact of rulings on real life,” said Wagner.

Turtle-excluder devices, aka TEDs, were the focus of an early trade dispute that opened the door for later cases in which environmental laws are seen as creating unfair restrictions on international trade. Photo by C. Ortiz Rojas, in the public domain.

The WTO appellate body that handled the case also noted that nations do have the right to act in protection of endangered species, writing, “We have not decided that the protection and preservation of the environment is of no significance to the Members of the WTO. Clearly, it is. We have not decided that the sovereign nations that are Members of the WTO cannot adopt effective measures to protect endangered species, such as sea turtles. Clearly, they can and should.”

The core of the problem, they concluded, was the discrimination the US had shown, chiefly by failing to negotiate with foreign aquaculture farmers or attempting to reach a compromise prior to imposing sanctions.

Wold said in an odd way the whole situation turned out for the good of sea turtles. In the wake of the dispute, the US and Southeast Asian nations formed unilateral trade rules to protect the marine mammals. And of the 14 countries initially facing the embargo, all but French Guiana have gone through turtle-excluder device training programs and agreed to include the equipment on fishing vessels.

“Though it had been argued by the contesting parties that sea turtles were an exhaustible resource in the same manner as say, minerals, the panel made it clear,” said Wold. “They essentially said we’ve learned our lesson — we can and have driven multiple species to extinction — far past the point of return. And unlike minerals, once they’ve gone, a species cannot recover. There’s no process of restoration, regardless of the thousands of years that transpire.”

Yet despite this small victory, Wold, like nearly all those interviewed for this story, said that by the time NAFTA was put into force, the environmental community was very concerned. The anti-environmental, pro-investor precedent set by past cases was hard to ignore, and the provisions that had allowed them, were only intensifying.

Sleeping Beauty

While these early GATT and WTO cases alerted environmentalists to the potential threats lying ahead, more importantly they whetted the appetite of corporate lawyers to the potential leveraging power of trade agreement investor provisions.

More and more, trade treaties were viewed as a way to muscle aside national laws, undermining environmental protections, or seen as insurance policies, guaranteeing profit on international investments whether they succeeded or not.

Most of the world’s more than 3,000 existing trade treaties and agreements had already been signed by the time ISDS was really put into practice, explained Weiler. But ISDS was there, ready to be utilized as the world entered a rapid period of economic globalization at the end of the 20th century — a time when investors were just beginning to see the massive profits to be gained from exploring for, and exploiting, international natural resources — especially in developing nations whose governments welcomed those investments.

Yet it wasn’t until the NAFTA disputes that ISDS really gained popularity. “In the first 25 years of its existence, ICSID ruled on just four cases,” said Weiler. “Just because a mechanism is there doesn’t mean people will use it. I like to think of ISDS like Sleeping Beauty, who lawyers awoke after a 20 year nap.”

When the first few big NAFTA Chapter 11-based dispute cases hit Europe, a bit of a shockwave ensued, said Nathalie Bernasconi-Osterwalder, group director of the Economic Law & Policy Program at the International Institute for Sustainable Development (IISD). In the past, trade investment provisions were seen as a way of protecting investors in developed countries against losses in the developing world. But suddenly, the investment process had become open to other possibilities.

“A lot of the provisions in trade and investment agreements lay dormant for a long time, so the first few big NAFTA cases were totally unexpected because they saw [developed nations] like Canada and the United States being sued,” said Bernasconi-Osterwalder. After 2000, she noted, more and more cases were brought forward. “Law firms and investors now knew about the process and began [excavating ambiguous provisions within] treaties not often used or even known about [in the past].”

Regardless of the supposed environmental protections brought by the NAFTA Side Agreements, it turns out that the treaty’s naysayers were largely right. According to the experts, once corporations and law firms got a taste of the rich payouts achievable from failed investments, dispute cases began to be seen as cash cows. And the allure of reward was so strong it became economical to challenge even the wealthiest of nations’ environmental standards.

Sleeping Beauty was wide-awake and had a plethora of new super powers, not to mention a legion of new allies and followers. The dispute mechanisms so carefully designed after World War II had been transformed into legalistic machinery capable of overturning environmental laws, and of mining the natural world for profit without borders. And with roughly 3,000 trade treaties and agreements that include ISDS provisions, there were nearly endless new ways and directions in which to drive that machine on into the 21st Century.