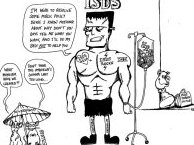

Under investor-state dispute settlement (ISDS) provisions found in trade and investment agreements, many laws for the protection of workers’ rights can be threatened, if a foreign investor argues they have a discriminatory effect on their interests.

Corporations could deem unfair any change of policy that improves workers’ rights and conditions, if they see it as a violation of their “legitimate expectations”, - their expected profits. Foreign companies consider they have a right to a stable regulatory context, and governments should not alter laws or regulations, even if public interest objectives such as fundamental labour rights are at stake.

If a state did enact new social and labour rights such as collective agreements, equal pay or decent minimum wage, companies could use the ISDS mechanism to challenge them.

Likewise, any reform favouring local companies or workers could potentially be the target of ISDS disputes.

The most well-known cases include:

• Piero Foresti & others vs. South Africa: in 2007, Italian and Luxembourg investors lodged an investor-state arbitral claim against South Africa for US$350 million because a new mining law contained anti-discrimination rules from the country’s Black Economic Empowerment Act, which aims to redress some of the injustices of the apartheid regime. The law required mining companies to transfer a portion of their shares into the hands of black investors. The dispute was discontinued in 2010, after the investors received new licenses requiring a much lower divestment of shares (Italy-South Africa and Belgium-Luxembourg-South Africa BITs invoked).

• Véolia (France) vs. Egypt: In 2012, the multinational utility corporation launched a dispute against Egypt, demanding US$110 million following changes to Egypt’s labour laws leading to an increase in minimum wage. In May 2018, Veolia lost the arbitration but Egypt had to spend six years defending the case and likely pay millions of dollars in arbitration and legal costs (the amount has not been made public) (Egypt-France BIT invoked).

• Abitibi-Bowater (US) vs. Canada: the US paper corporation challenged the decision of Newfoundland and Labrador, a Canadian province, to confiscate various timber, water rights and equipment held by Abitibi-Bowater after the corporation closed a paper mill in Newfoundland, putting 800 employees out of work. Case was settled in 2010 for US$122 to the investor (NAFTA invoked).

(March 2020)